Protect your loved ones through the Circle of Life.

Best Term Insurance Plans in India

Term insurance plans are also called pure life insurance plan that provides coverage for a certain period of time or a specified “term” of years. If the insured dies during the time period specified in the policy and the policy is active or in force, then the death benefit will be paid. The premium paid on term life insurance is used to cover the risk of insuring the policyholder. This allows the policyholder to opt for higher sum assured at affordable premiums. Term insurance is the best way to financially secure your family’s future in case of any untoward scenario. It covers the policyholder for a long period of time. Generally, the policy term starts from the age at which the policy is purchased. It ends when the policyholder reaches the age mentioned in the policy. Thus, it is possible to get a term insurance policy for 50 or even 60 years at the affordable premium which may vary during the premium paying term. Term insurance plans also comes with riders which provides additional coverage asides the term insurance benefit. These riders cover additional benefits such as accidental death, accidental disability, critical illness diagnosis, terminal illness diagnosis, waiver of premium and provide extra benefits that are paid out when the conditions are met. Term insurance allows the policyholder to opt for a high sum assured. This policy provides the best way to financially secure your family’s future.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Death Benefit

The sum assured under term insurance online is paid out in case of death of policyholder to the appointed nominee.

Non linked Plan

A term plan’s sum assured is not linked to any market factors.

Medical Tests

Most insurance companies require a mandatory medical tests as per their risk assessment criteria before issuing the insurance policy. Some companies have started offering tele medical check-ups.

Term Insurance Riders

A policyholder can opt for riders that provide additional coverage. Some of the common riders are:

Policy Tenure

A typical term life insurance policy tenure starts at certain age of the policyholder and continues till the age up to which the life insured needs life protection. There are many plans in the market that provide “whole life protection” at reasonable premiums.

Free look Period

Term insurance policies have a free look period of 30 days/15 days. This means the policyholder can choose to purchase life protection; however, if he decides to cancel the policy within 30 days & policyholder is offered a full refund.

Grace Period

A term insurance policy has a grace period of 15 to 30 days. In case a policyholder is late with payment of premium, the insurance company allows the policyholder to pay premiums within the grace period without the policy lapsing. If premium is not paid within this period, the term insurance policy lapses

Term insurance is an insurance product that provides financial security to the family members of a sole or co-income earner. It does this by paying a pre-decided sum of money to the family in the eventuality of the breadwinner's unforeseen death.

The primary aim of term insurance is to extend this insurance coverage in the scenario of death. However, with the inclusion of riders, additional insurance coverage can be availed against debilitating and life-altering eventualities. These include critical illness rider, serious illness rider, accidental death benefit and accidental disability benefit. Here are two examples of how term insurance works through two different term insurance plans:

Mr A buys a basic term plan that will pay a pre-agreed sum assured to his loved ones on his death, provided the demise is within the tenure. He has the option to add extra riders to his term plan, like the critical illness rider, an accidental disability rider, and others. However, as he chose a base term policy, he will not get any returns of premiums paid in case he survives the term policy.

Mrs B buys a term plan that will also pay a pre-agreed sum assured to her loved ones on her death, provided her demise is within the tenure. She also has the option to add extra riders to her term plan, like the critical illness rider, an accidental disability rider, and others. But she will receive the premiums paid as returns if she survives the term policy as she chose a term plan with a return of premium option.

In both term plans, the coverage offered remains somewhat similar, except for the riders that are customisable. The core difference is that Mrs B would get her invested money returned to her even if she survives the term plan, ensuring minimal loss.

PNB MetLife Term Plan Calculator will help you calculate how much term insurance you need and the premiums payable for that amount. It does this by considering factors like your age, gender, annual income, lifestyle habits, and the desired term insurance cover amount and policy tenure, among other factors.

It considers factors shaping your life and your plan preferences to select term plans that best serve your financial requirements. The term insurance calculator will also suggest the premiums payable for each term plan and give you various premium paying modes to choose from.

There are many term insurances benefits that make it an excellent investment to secure the financial safety of your family.

One of the major benefits of a term insurance plan is the affordability of premium. It is possible to get a cover of 1 crore Term Insurance without spending a huge amount. Term insurance premiums purely reflect the risk of covering the life of the policyholder. For Non-smokers, premiums are lesser. Insurance companies also charge lesser premiums for healthy policyholders. Women policyholders typically enjoy lesser premiums than men. All these factors make it possible for people to opt for higher covers without it breaking the bank.

The tenure for a term insurance plan lasts from the age at which the policy was purchased and continues till the age specified in the policy. The term insurance policy ends when the policyholder crosses that specified age. For example, if the policyholder is 30 when he buys a term plan and the coverage under the policy is till the policyholder reaches 80 years, the policy duration is 50 years. Buy term plan online at a young age will ensure the premium is kept low and the sum assured is high.

Riders provides an additional coverage that comes along with a term plan. These cover scenarios such as accidental death, disability, critical illnesses etc. These riders have additional premium that has to be paid over and above the term insurance premium. However, they provide additional benefit when the given conditions are met. For example, if a Critical Illness Rider is opted for and the policyholder is diagnosed with one of the specified illnesses, then he will receive a payout for meeting the condition covered under the rider. The rider benefit, like the base policy benefit, will have to be decided at the inception of the policy which determines the min/max coverage term & benefits of the rider.

One of the biggest advantages of a term insurance plan is that these policies are easily available online. It is convenient to buy them directly from the insurance company’s website or with the support of an insurance web- aggregator or form any other insurance intermediary. Once the onboarding formalities are completed, the insurance company issues the policy document.

Term plans are counted as life insurance plans and get a tax deduction for premium paid under Section 80C of the Income Tax Act, 1961. This deduction is limited to Rs. 1,50,000 and it covers premium for self, spouse and dependent children. If the policy is taken for anyone else, a deduction will not be available. This deduction will only be allowed if premium paid is less than 10% of the sum assured. Another point to remember is that any benefit received under a term insurance policy is exempt under Section 10(10D) of the Income Tax Act. This includes payout for a term insurance rider as well. This guarantees the financial security of your family since no tax will have to be paid on term insurance benefits. The benefit can be wholly used for the family’s finances.

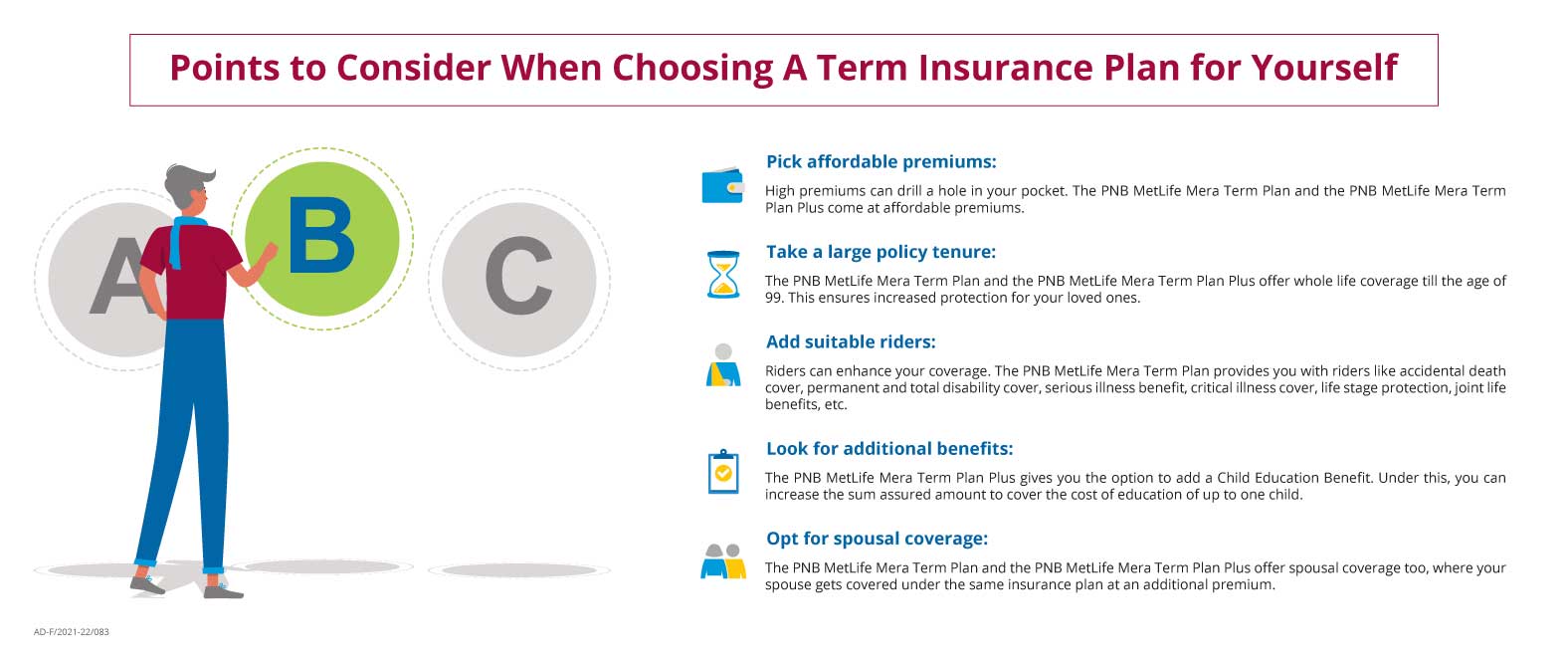

Benefits of having a Term Insurance Plan are Affordable Premiums, Policy Tenure, Easily Comprehensible with Flexible Payout Options. The below infographic showcases all these features in lucid way.

Term insurance is for those who want to secure their loved ones in their absence. It provides financial support to the family members of the sole or co-income owner of a family unit in the case of his/her unfortunate death or other unforeseen eventualities. Term insurance plans do this by providing a guaranteed death benefit on the demise of the life insured under the term plan in exchange for premiums paid by the policyholder. These premiums are payable through a one-time lump-sum amount or periodic instalments every month, quarter, half-yearly, or annually. Term insurance policies also provides optional benefits like

a) Lump Sum payment on diagnosis of listed Critical Illness or in case of any terminal illness

b) Benefits when the life insured is permanently disabled due to accident

c) Additional payment (over and above the base sum assured) on death due to accident

Term insurance is especially vital for self-employed individuals, working professionals, married couples, retired persons, and regular tax-payers. Having a term plan can help you reach various milestones of life, such as:

• Funding your child’s higher education or marriage

• Ensuring a retirement corpus for your spouse

• Supporting your family in day-to-day expenses if you are no longer around

Term insurance is the most affordable form of life insurance with an extensive scope of coverage. It is also very flexible and allows one to increase their insurance coverage at different life stages. Term insurance plans from PNB MetLife not only offer the aforementioned benefits but also provide that extra layer of protection through additional riders for enhanced security.

Buy PNB MetLife Term Insurance Plan in 3 Steps:

Step 1

Visit the PNB MetLife website https://www.pnbmetlife.com/. Click on ‘Buy insurance’ and select ‘Family Protection Solutions’. On clicking the box, you will find our term insurance plans offered. You can surf through them and choose the one matching your needs best.

Step 2

Once you find a term plan that suits you well, click on the ‘Buy Online’ option to calculate your term insurance premium payable. Enter the details asked, such as:

• Your date of birth

• Your annual income

• Your residential pin code

You also have to disclose if you are a smoker or non-smoker as smoking affects the premium price of a term plan. Ensure you do so in complete truth, as any misinformation can forfeit your eligibility to receive the benefits under the term insurance plan.

Step 3

After entering the required details, click on ‘Get Quote’. You will get the approximate value of the term insurance coverage you are eligible for and the value of the premiums payable. Thereon, select any additional riders or benefits you want to enhance your term plan. Once you finish the selection, you can choose your preferred mode of payment and pay accordingly.

A 1 crore term insurance plan pays a benefit amount or sum assured of ₹1 crore to your family members on your unfortunate demise. Term insurance plans that give a sum assured of 1 crore are an increasingly popular choice among buyers as they tend to have affordable premium rates and provide ample financial support in times of distress.

Moreover, as the amount is enough to combat inflation and sufficient to sustain a premium lifestyle, your loved ones will have the safety and strong backup they need in your absence. However, it is wise to use a term insurance calculator and find the exact term insurance you need to avoid getting inadequate coverage.

Before searching for term insurance plans, it is crucial to have a clear idea of how much insurance coverage you need. The death benefit payable under the term plan should be enough to cover your family’s needs for an extended period. Only you can decide how much term insurance you need. You can use any of these 3 methods to calculate this amount:

To find how much term insurance you need through the HLV Method, you need to calculate the total economic value of an individual throughout his/ her lifetime. Take into account:

• Your monthly or annual expenditure

• Any loans or debts

• The number of dependents you have

• The expected future goals and financial responsibilities for each dependent

Add these figures and multiply the total figure with the inflation rate 20 to 30 years down the line. That will be the amount of term insurance you need.

To calculate term insurance through the Income Replacement Method, multiply your annual income by the number of years left for your retirement. This method highlights how much term insurance will be enough to compensate for your lost income if you cannot earn for your family.

This method involves using the HLV method as the first step. After you arrive at the total value, you have to add up the sum of your investments and financial assets. Deduct this sum from the value arrived at by the HLV method, and that will be the amount of term insurance you will need.

Term insurance requires the payment of premiums. Premiums are the amount you pay towards the policy for receiving the insurance coverage and benefits in term insurance plans. Premiums are variable and depend on factors that are specific and personal to each buyer. These include:

Age is a crucial factor in deciding how much premiums you will have to pay. The older you are, the higher will your term insurance premium be. That is why we recommend starting your search for term insurance plans early in life. The cost of premiums reduces if you are young and the benefits offered are also extensive.

Gender also plays a considerable role in influencing premiums. In general, women pay higher premiums than men as their biology makes them need medical attention more often. PNB offers the best term insurance plans, with special premium rates for women.

A buyer’s medical history is of importance in deciding the term insurance premium payable. If the buyer suffers from any health issues, has a family history of specific diseases, or works in a profession that carries risk, his/ her premium will be higher than usual. This is because the presence of any health risks increases the liability. To balance the scales, those with a compromised medical history are charged higher premiums.

Lifestyle habits also affect the premiums of term insurance plans. If you smoke (irrespective of how rare or habitual) or drink alcohol (in excess), it can increase the cost of your premiums. Smoking has a larger impact on premiums, but alcohol drinking in limit does not pose a threat to them.

The term of the term insurance plan also determines the premium price. The longer the term is, the higher premium will be applicable.

One of the biggest boons of living in the present age is the comfort of digital purchases, payments, and transactions. Many processes like buying term insurance were time-consuming and required a lot of paperwork back in the day.

But now, with the shift to everything digital, you can buy the best term insurance online in a matter of minutes. The entire process - from comparing the term policies to finalising one and making the payment is easy, paper-free, and convenient. You can calculate the premiums payable, choose a term plan according to your requirements, submit the documents needed, and make online payments. The whole process is quick and transparent, and you will receive a soft copy of the term insurance policy in a few minutes.

Broadly put, term insurance is of two types – term insurance with no return of premiums and term insurance with return of premiums. The PNB MetLife Mera Term Plan Plus is a fine example of term insurance with a premium return.

In basic term insurance plans without premium return, you lose out on your invested money if you survive the term plan. And while you get coverage for the entire tenure, not getting any survival benefits can be disappointing.

But with a term insurance plan that returns the premiums paid by you in full, you can get the dual benefit of life coverage and return of invested money. In addition, choosing this option to pay some extra premiums will ensure that you either get death benefits or maturity benefits, depending upon the situation.

Term insurance is one of the most affordable forms of insurance. However, if you want to cut back on premium prices, there are certain things you can do.

Term insurance is one of the best tax-saving tools, and the deduction available under section 80C is one of the most popular tax-saving options. Under Section 80C of the Income Tax Act, 1961, you can get a tax deduction on the premium paid towards a term insurance plan. You can claim a deduction of up to ₹1,50,000 in a year.

You can save further on tax under section 10(10D) of the Act. Under this provision, the death benefit your family receives will be exempt from tax. Moreover, the maturity benefit is non-taxable provided the premiums paid towards a term insurance plan do not exceed 10% of the sum assured or benefit amount for policies purchased on and after 1st April 2012. For policy purchased before 1st April 2012, the premium paid should not be more than 20% of the sum assured to avail the tax benefit on the maturity amount.

Choosing the right term insurance plan is a multi-step process and buying the first term plan you come across is not advisable. To start the process, you need to:

The search for term insurance plans should begin as early as possible. Do not wait for any crisis to strike before you get a term insurance plan. A delay could leave your family without financial protection. It will also make buying term insurance an expensive affair.

Buying a term plan without assessing your financial needs first is futile. You could end up with inadequate coverage, which will be of little use to your loved ones. Coming to the approximate amount of life insurance coverage, you will need to consider:

You will have to add these figures and multiply the final value with the inflation rate applicable in the last year of your term plan. The sum you arrive at will be the closest amount of insurance coverage you will need.

This is a step that most people miss. Where you are buying your term plan from is vital in ensuring that you get your claim settled in promptness when needed. You should consider factors such as the company’s reputation in the insurance industry, its claim settlement ratio (that is, the number of claims settled by it in a year), and its turnaround time for claim settlement. PNB MetLife is a leading insurance company with a remarkable claim settlement ratio of 97.18% in the financial year 2019-2020. We also settle claims within 3 hours, so you can rest assured that your financial needs are in good hands.

Lastly, check the benefits offered by term insurance plans in detail. Ensure to read the policy wordings in their entirety before you close in on a purchase.

PNB MetLife is one of the topmost insurance companies in the country. PNB MetLife has been in the insurance business since 2001 and has insured 3.16 million people till date. One of the world’s leading insurers MetLife has tied up with Punjab National Bank (PNB) to protect and insure people. With a high claim settlement ratio, buying a best term insurance from PNB MetLife will ensure your claims are honoured and easily settled. Be rest assured, your family’s claim will be speedily paid out. Buying a PNB MetLife policy is very simple and convenient. Moreover, you can completely customize your policy as per your needs and requirements. Whether you require additional riders or upgradation of your sum assured, your needs come first. PNB MetLife offers one of the best term life insurance policies in India.

The duration of your term plan should not be too short or too long. Term insurance plans with a shorter duration tend to be inadequate. Those with a long-term period can cost you unnecessary premium payments. There is a simple way to arrive at the ideal term of your term insurance plan. A term plan should be enough to cover you at least up to your retirement age. The older you are, the lesser the plan’s duration will be.

At PNB MetLife, you can avail of an offline or online term plan from any of the term insurance plans available. They are:

Life Cover

Protect your loved ones with a sum assured (ideally 7 times that of your annual income) even in your absence.

Riders

Get additional benefits in the form of health riders and protection against accidents, critical or serious illnesses.

Non-Linked plans

Term insurance plans are suitable to those who have a lower risk appetite as they are not linked to any market factors.

Affordable Premiums

Low premium rates set Term Insurance Plans apart from other life insurance plans. Non-smokers and women typically enjoy lower premiums.

Tax Benefits

Your life insurance policy can get you tax benefits from the moment you start paying premiums! Availing this benefit can help you save up to Rs. 1,50,000 from your taxes. However, you can claim this benefit only when the premiums paid don’t exceed 10% of the sum assured (under sec 80 C, I-T Act, 1961).

The documents you require are:

Here are some pointers to consider before choosing the perfect term insurance policy

The insurance company calculates premium for your insurance policy based on several factors such as:

The term insurance premium is an indication of the risk that the insurance company has to bear to insure the life of the policyholder. These premiums are calculated by the company using actuarial tables to assess risk. However, each insurance company also has a term insurance premium calculator on their website that will let you know an approximate premium for the given inputs entered by you. The final decision is left to the insurance companies but using a term insurance premium calculator will give you an estimate of how much premium you can be expected to pay. Using this calculator will help you budget for yearly premiums in your finances.

It is possible to buy family term insurance as well. Several term plans also include a joint life benefit. A joint life benefit includes coverage for the spouse as well. This covers the life of both the policyholder and the spouse. Even if either the policyholder or the spouse dies, the term insurance policy continues till the death of the other. Getting a term plan for your family or a group term life insurance policyis an excellent choice. A family’s finances are interconnected and buying a term plan can ensure high coverage and financial security in case of any emergency.

A term plan also comes with an option to return the premiums on maturity. The premium for such plans is slightly higher than pure term insurance policies but opting for such policies can help meet family expenses on maturity of the policy.

A

Age limits This is the maximum or minimum age for availing a life insurance policy

Annuity Plans Annuity plan is an insurance product that helps you plan for your retirement. This plan provides you with guaranteed income after retirement and for the rest of your lives

Assignee An assignee is a person who is assigned to the title, rights, and benefits of a life insurance policy

Assignor Assignor is the person who transfers the title, rights, and benefits of the life insurance policy to the assignee

Applicant / Proposed The person who applies for the insurance policy and becomes part of the insurance contract after a policy is issued is known as applicant

Assured / Insured Insured/assured is the person who is legally entitled to avail benefits covered under a policy

B

Beneficiary A beneficiary is someone eligible to receive the payouts from an insurance policy when the policyholder dies

Bonus Bonus is the extra amount of money which one gets over the basic sum assured during the policy term

C

Claim Amount It is the amount which is to be paid to the insured or beneficiary by the insurance company at the maturity of the policy or upon the death of the policyholder

D

Death Benefit It is the amount of money paid to the stated beneficiary or nominee of a life insurance policy upon the death of the policyholder

Deferment Period This is the time between the date of policy inception to the vesting date

Deposit Term Insurance There's no involvement of 'deposit' as such. This is a type of term insurance where premiums paid in the starting year are more than the premiums to be paid in the forthcoming years

E

Endowment Policy This is a type of insurance policy that offers the dual benefits of insurance and savings under one single policy. You can avail lump-sum amount in the form of maturity benefits when the policy term comes to an end

G

Group Insurance It covers a group of people who are involved in common activities such as employees of a particular organization, members of a particular society, etc. It provides insurance protection to several people under one policy

Guaranteed Addition This is a guaranteed benefit added to your basic sum assured and is payable at the time of maturity or death of the policyholder

I

Insurability It is the degree of an individual's vulnerability to risk factors that are based on their health, susceptibility to different contingencies, and local factors affecting life expectancy

Insurable Interest It refers to the continuous financial benefit that is derived from the insured person, which after his death would get void. For self-insurance, the presumptive insurable interest is unlimited

K

Keyman Insurance This is a type of insurance where the employer buys a life insurance policy and pays the premium but the life to be insured is that of the employee

L

Lapsed Policy A policy that has been canceled for not making premium payments on the due date or even within the grace period

Life Assured The life assured is the one whose life is being insured under a life insurance policy

Loyalty Additions Loyalty additions are the additional benefits that an insurance company offers to a policyholder if they stick to the policy throughout the term

M

MaturityThis refers to the date on which a policy matures

Maturity Claim The amount of money that the policyholder receives at the end of the policy term is called a maturity claim

N

Nomination Nomination is a process whereby the policyholder nominates a person or persons to receive death benefits in case the insured dies

P

Policy It's a contract between the policyholder and the insurance company wherein the policyholder pays premium during the policy term and in return, the insurance company offers financial coverage

Policy Period This is the time period during which your policy is valid

Premium Notice This is the notice issued by the insurance company to notify a policyholder that a premium will be due on a given date

Paid-up Value This is the reduced amount of sum assured paid by the insurer in case you fail to pay your premiums on time and policy lapses

Premium A premium is a payment or installment made by the policyholder to the insurance company for covering his/her risks

R

Reinstatement The process of renewing a lapsed policy is known as reinstatement. As per this clause, a lapsed or terminated life insurance policy can come in to force again

Risk Risk is a danger or threat covered by the insurer when a policy is issued. This is an event or happening that may occur to the insured and can lead to huge financial losses

Rider A rider is an add-on cover added above your insurance policy. These are additional coverage options that come in to force along with the policy at an extra cost

Rebating Rebating is defined as an offering given to a prospective insurance buyer as an inducement to buy a policy. This practice is strictly prohibited under law

Reinsurance Reinsurance is a practice where insurance companies buy insurance from other insurance companies to protect themselves against financial losses

Renewable Term Insurance This is a type of term insurance policy that allows you to renew your policy at the end of the policy term regardless of your current insurability

S

Solvency Margin Solvency margin determines the net worth of an insurance company. As per IRDA, insurance companies need to maintain a solvency margin i.e., the surplus of capital over the number of liabilities

Suicide Clause This is a clause in the policy contract stating that the insured person's beneficiary or nominee will receive no death benefits if the policyholder commits suicide in the initial years of the policy

Sum Assured This is the amount that an insurance company pays to the policyholder at the time of maturity or in case of any eventuality such as death

Surrender Value This is the amount of money that insurance company pays to the policyholder when he/she decides to discontinue the policy before its maturity

Survival Benefit This is the amount that an insured person will get if he/she lives till the end of the policy term and the policy is still in force

T

Term The time period for which a life insurance policy is in force and offers coverage to the policyholder

Term Life Insurance As the name suggests, term life insurance is a pure protection plan that offers financial coverage to the policyholder for a defined time period

U

Underwriting This is the process where insurance companies assess the risks associated with the prospective policyholder. Also, they evaluate their insurance needs and how much a policyholder needs to pay for it

Uninsurable Risk Risks that are not covered by an insurance company, either because it is not appropriate or not eligible to be insured

V

Void Contract A contract or policy that has no legal validity. Under a void contract, no claim is payable and no return of premium shall be made

W

Waiting Period This is the time during which you cannot claim any benefit offered by an insurance company

Y

Yearly Renewable Term This is a type of short-term insurance policy that offers insurance coverage for a period of one year. Here, the insurance premium is quoted for one year

There are a variety of insurance products that can help you financially secure your life. A term life insurance is the simplest and the most basic type of insurance. It guarantees the payment of a death benefit in case the insured passes away during the policy term. A term life insurance plan generally does not have any savings component, which makes it one of the cheapest life insurance plans. A term life insurance cover ceases to exist after the expiration of the policy tenure. Some term life insurance plans also offer ‘riders’ which handily provide the policyholder enhanced coverage at a low cost.

In case of an unfortunate event, if the need arises, it is exceptionally easy to file an insurance claim. There are three distinct steps to filing a term insurance claim.

Intimation: The first step while filing a claim is to inform the insurer about the death of the insured. The insurance company has to be intimated within 90 days of the death of the insured with relevant documents like death certificate. With PNB MetLife, you can download the claims form online in your regional language and send the duly filled form to the company.

Processing: Upon receiving the claim forms, the insurance company verifies the documents and assesses the claim’s merit. The insurer can ask for additional documents or choose to examine the claim further. The exact documents slightly vary depending on the type of policy and the insurer. The documents required to file a claim with PNB MetLife are as under:

The basic documents remain the same but may vary slightly in the case the policy covers accidental death or critical illness.

Payout: The claim is processed within 30 days of the submission of relevant documents. In case of an investigation, the investigation is completed within 90 days from the intimation of the claim. The final decision on the claim is taken by the PNB MetLife within 30 days of the completion of the investigation. What is term insurance plan premium? Term insurance is essentially an agreement between the insured and the insurance company. The insurance company promises to pay the insured a pre-decided death benefit on the condition that he/she regularly pays a mutually decided premium. The insurance company uses the premium to provide the death benefit. Insurers very often provide flexibility in premium payments. Generally, term insurance premiums can be paid on a monthly or yearly basis.

Term insurance is essentially an agreement between the insured and the insurance company. The insurance company promises to pay the insured a pre-decided death benefit on the condition that he/she regularly pays a mutually decided premium. The insurance company uses the premium to provide the death benefit. Insurers very often provide flexibility in premium payments. Generally, term insurance premiums can be paid on a monthly or yearly basis.

A term insurance plan takes into account the potential risks to the insured and the premium is calculated accordingly. A high-risk individual will have to pay a higher premium when compared to an individual with moderate risk. Risk can be of various types; for instance, occupational risk. Nicotine use is also a type of risk. Continuous use of nicotine can result in respiratory illness, heart diseases or even cancer. Since many term insurance plans cover critical illness, heart diseases and cancer, insurers naturally charge a higher premium from nicotine users. While buying a term insurance plan online, you have to clearly state your history of nicotine use. If an individual is a nicotine user, his/her premiums maybe a third higher than a non-user. Concealing nicotine use while buying a term insurance plan could lead to the rejection of the claim.

A term insurance policy guarantees monetary payout to the nominee in the event of the insured’s death. Besides the death benefit, term insurance plans generally do not provide other monetary benefits. However, you can claim tax benefits on the premiums paid for a term insurance policy. The premiums paid for yourself, your spouse and children are eligible for a tax deduction of up to Rs 1.5 lakh in a year under Section 80C of the Income Tax Act, 1961. Some best term insurance plans also return the premiums paid after the end of the policy term.

If the insured does not die within the policy tenure of a term insurance plan, the policy simply ceases to exist. Term insurance policies do not have a savings component and hence there are no maturity benefits. The insured can also choose to renew the plan. Policies with the ‘return of the premium’ clause pay back the premiums paid during the policy term.

Buying a term insurance plan with a Sum Assured which is significantly more than you need can be a drain on your finances. Similarly, being underinsured can be counterproductive. The optimum cover depends on your annual income, liabilities and your financial goal. As a thumb rule, you should have a term insurance cover equal to 15-20 times your annual income. To get a better idea of the required term insurance cover, you can use the ‘protection calculator’ in the ‘tools’ section of www.pnbmetlife.com.

If the insured does not die within the policy tenure of a term insurance plan, the policy simply ceases to exist. Term insurance policies do not have a savings component and hence there are no maturity benefits. The insured can also choose to renew the plan. Policies with the ‘return of the premium’ clause pay back the premiums paid during the policy term.

Term insurance plans pay the sum assured in the event of the death of the insured. However, people seeking better coverage can opt for riders, which essentially enhances the basic policy. You have to specifically opt for such riders while buying the policy. Term insurance policies with riders have higher premiums when compared to basic policies. Some of the riders offered with best term insurance plans are:

Even though a term life insurance policy is designed to cover death, there are certain types of death that are not covered by term life insurance policies. Deaths due to the following reasons are not covered by term insurance.

Term life insurance is bought to financially secure the life of our loved ones, however, some intentional and unintentional mistakes can defeat the purpose of taking the policy. Insurance companies reject term insurance claims due to several reasons.

Giving incorrect details: While filling the form for term life insurance, ensure that you provide correct details. Insurance companies take concealment of information or providing incorrect information very seriously and it could lead to the rejection of the claim.

Hiding medical history: Not disclosing medical history is valid ground for ejection of the claim. If it is found that the insured had a pre-existing disease which was not declared in the insurance form, the insurer may reject the claim. Some people also hide their smoking or drinking habit to reduce the premium. It could also result in the rejection of the claim.

Refusing to undergo medical test: While buying a term life insurance plan, you are required to undergo a medical examination. The insurance company uses the medical test to assess the risk. Refusal to undergo medical examination could lead to the rejection of claim later.

Not disclosing existing policies: When you buy new term insurance, you are required to provide information about any existing policies. Failure to reveal existing policies can result in the rejection of the claim.

Yes, you can have multiple term insurance plans. However, it is not wise to buy more than two term insurance policies. Most people get multiple term insurance policies because they fear they may face claim rejection. Even though buying multiple term insurance policies provides more security, it increases the total amount of premiums you have to pay. This is not feasible in the long run as you could end up putting a strain on your financial resources. It is advisable to stick to one term insurance policy from a reliable and trusted insurance company like PNB MetLife.

We have a reputation for settling a large part of our term insurance claims - and only within 3 hours! Our claim settlement ratio of 97.18% in the financial year of 2019-2020 is a testament to the value we place on our customers’ lives. It would also be prudent to remember that you cannot buy two term insurance plans from the same insurer. Moreover, when you get your second or third term insurance policy, always disclose the fact of your purchase to the previous insurer to avoid any claim rejections in the future.

Yes, the term insurance plans of PNB MetLife cover COVID-19 death claims. These include:

We also cover COVID-19 hospitalization expenses and COVID-19 death claims in our PNB MetLife. PNB MetLife Mera Mediclaim Plan is a one-of-a-kind insurance product that provides the dual protection of life insurance and health insurance.

Term insurance is the purest form of life insurance offering limited benefits. Life insurance is an umbrella term for various kinds of life insurance products. Here are the main differences between term insurance plans and life insurance plans:

Buying term insurance or life insurance plans depends on your needs and budget. Both term insurance and life insurance plans have unique benefits to offer. If you want a simple life cover that provides extensive financial support to your beneficiaries in times of need, you can go for a term plan. The premium price of a term plan is also nominal and affordable, and exiting it is far easier than cancelling a traditional life insurance plan. Buying an online term plan also helps you save on premiums as they remove the costs of any administration or agent’s fees.

Traditional life insurance plans are also convertible. But there may be cancellation charges applicable for switching over to a term plan. They have an edge over basic term insurance plans as they offer the dual benefit of life insurance protection and maturity benefits and so, the premiums are on the higher side. You can get both term insurance and traditional life insurance plans online from the comfort of your home.

Term insurance plans offer single and regular modes of premium payment. The single pay requires you to pay the entire premium amount at one go. The regular pay gives you the freedom to pay in instalments every month, quarter, half-yearly, or annually. You can switch between the two payment modes but only on the renewal date of the term insurance plan. You can contact us via our registered details available on our customer service page to know more about the same. Paying in instalments can be more convenient than paying a one-time lump sum. However, lump-sum payments can cost you lesser premiums in the long run.

You can get a term plan that offers coverage of ₹1 crore in the same way as other term insurance plans. It is better to buy an online term plan than offline as doing so will save you money and time. A 1 crore term plan offers a high death benefit for an affordable premium price. PNB MetLife’s Mera Term Plan is a simple term insurance plan that can offer you this amount. The premium amount, however, will depend on the policy term, the premium payment term, etc. However, before you choose a term insurance plan, you should assess your needs and calculate the approximate amount of funds your family will need in your absence. Sometimes, a cover amount of ₹1 crore might not be enough. Unforeseen expenses can arise anytime, so it is prudent to get a sum assured that fits your needs. Moreover, with inflation on a continuous rise, this amount might not be enough to meet the then-current rate of things. Term insurance plans with a ₹1 crore cover are affordable and convenient.

The working of a term insurance plan is simple. It is the most basic form of life insurance and provides a guaranteed death benefit to the family members of the life insured in case of his/ her demise. Term insurance plans are well-known for providing extensive insurance protection at affordable prices.

The coverage provided only lasts during the term of the term insurance plan. In pure term insurance plans, if the life insured survives the term, he/she does not receive any maturity benefit. However, PNB MetLife’s Mera Term Plan Plus is the best term insurance plan as it returns the premiums paid as a survival benefit. This way, you do not lose out on your hard-earned investment and also remain covered for the entire term.

Term insurance plans also come with additional riders for an added layer of financial protection in case unforeseen events arise. These include accidental death, permanent disability arising due to an accident, and diagnosis of a critical or terminal illness. So, in the event the life insured suffers from any of the above scenarios, his/ her family will receive extra financial support to ensure there is no threat to their stability.

The premiums of term insurance plans need to be paid on time to keep the term insurance plan in force. However, sometimes you can miss a payment due to a time crunch or any unforeseen expenses. You can also simply forget that your payment date is near. In such cases, we provide a 30-day grace period to complete payment.

If you fail to make payment even during this period, your term insurance plan will lapse. The best way to avoid this hassle is to set a fixed reminder for your payment date. Moreover, you will also receive reminders from us from time to time to make the payment on time. Another way you can avoid defaulting is by making a one-time lump-sum payment for your term insurance plan.

We understand the devastating impact of the coronavirus outbreak across the globe. Vowing to be your life insurance partner at all times, we will walk with you every step of the term insurance claim journey.

It is best to invest in a term insurance as early as possible. Once the premium has been decided on a term insurance plan, it does not change for the entire policy duration. To keep premium costs low even with a high sum assured, it is recommended to buy a term life insurance as soon as possible.

There are many different insurers offering term insurance policies in India. The best term insurance plan is one that meets all your needs and gives you the flexibility to choose. However, with PNB MetLife, you can customize your term plan.

There are 6 different types of term plans available:

• Return of Premium Plans:

This term plan comes with a feature to return the premium paid during the term plan duration.

Under this option, the sum assured keeps increasing either after the passage of time or after certain life goals such as marriage, birth of the first child, the birth of the second child etc. Under these plans, the premium amount stays the same but the sum assured keeps increasing.

• Term Plans with Riders:

Term riders provide additional coverage over and above a term insurance policy. The sum assured under a term rider is paid out when the conditions mentioned in the term rider are met. Term policies are issued with riders to provide additional coverage.

A term plan covers the risk of death of the policyholder, critical illness rider. If you opt for term riders, you can get additional coverage in case of accidental death or critical illnesses.

Yes, term insurance plans do offer tax benefit. A term insurance plan for self, spouse, and children gets a deduction under Section 80C of the Income Tax Act up to Rs. 1, 50,000.

The general eligibility criteria for securing term insurance are:

Term insurance is one of the most famous tax-saving instruments. Under Section 80C of the Income Tax Act, 1961, you can get a tax deduction on the premium paid towards a term insurance plan. You can claim a deduction of up to ₹1,50,000 in a year.

You can save further on tax under section 10(10D) of the Act. Under this provision, the death benefit or sum assured your family receives will be exempt from tax. Moreover, the maturity benefit is non-taxable provided the premiums paid towards a term insurance plan do not exceed 10% of the sum assured or benefit amount for policies purchased on and after 1st April 2012. For policy purchased before 1st April 2012, the premium paid should not be more than 20% of the sum assured to avail the tax benefit on the maturity amount.

Additionally, you can also save tax indirectly under section 80D of the Act by adding health-related riders to your term plan. Adding riders like the critical or serious illness rider, for instance, can help you claim a deduction on the tax paid during the year.

Smoking is a detrimental habit that reduces your lifespan and threatens to bring upon a host of debilitating diseases like cancer, heart disease, and others. Therefore, insurers consider it a direct risk to your lifespan and an increased liability in providing you insurance coverage.

When a person is in the pink of health, has no harmful lifestyle habits like smoking, and has lower threats of carrying on hereditary illnesses, they have a higher chance of living longer. A person having a better shot at a better lifespan automatically reduces the liability of insurance companies compared to a person who smokes and exposes themselves to significant health issues. In some cases, smokers get charged higher premiums.

Term insurance riders are extra add-on covers that provide additional financial protection over and above the base coverage in a term insurance plan. The base coverage in a term plan is the death benefit, or sum assured payable to a family on the policyholder's demise.

However, other unforeseen situations in life can threaten to bring everything to a halt. For instance, the diagnosis of a critical illness or a permanent disability caused due to an accident are serious eventualities that can impact the quality of your life.

Term insurance riders protect you against the aftermath of such scenarios by providing additional financial support in the form of a rider pay-out. This rider pay-out ensures your family continues to achieve their goals, sustain their lifestyle, and you have enough for getting back on your feet.

Some of the most popular riders include critical illness rider, accidental disability benefit, accidental death benefit, and serious illness rider.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice