Individual, Non-Linked, Non-Participating, Pure Risk Premium, Life Insurance Plan | UIN: 117N122V05

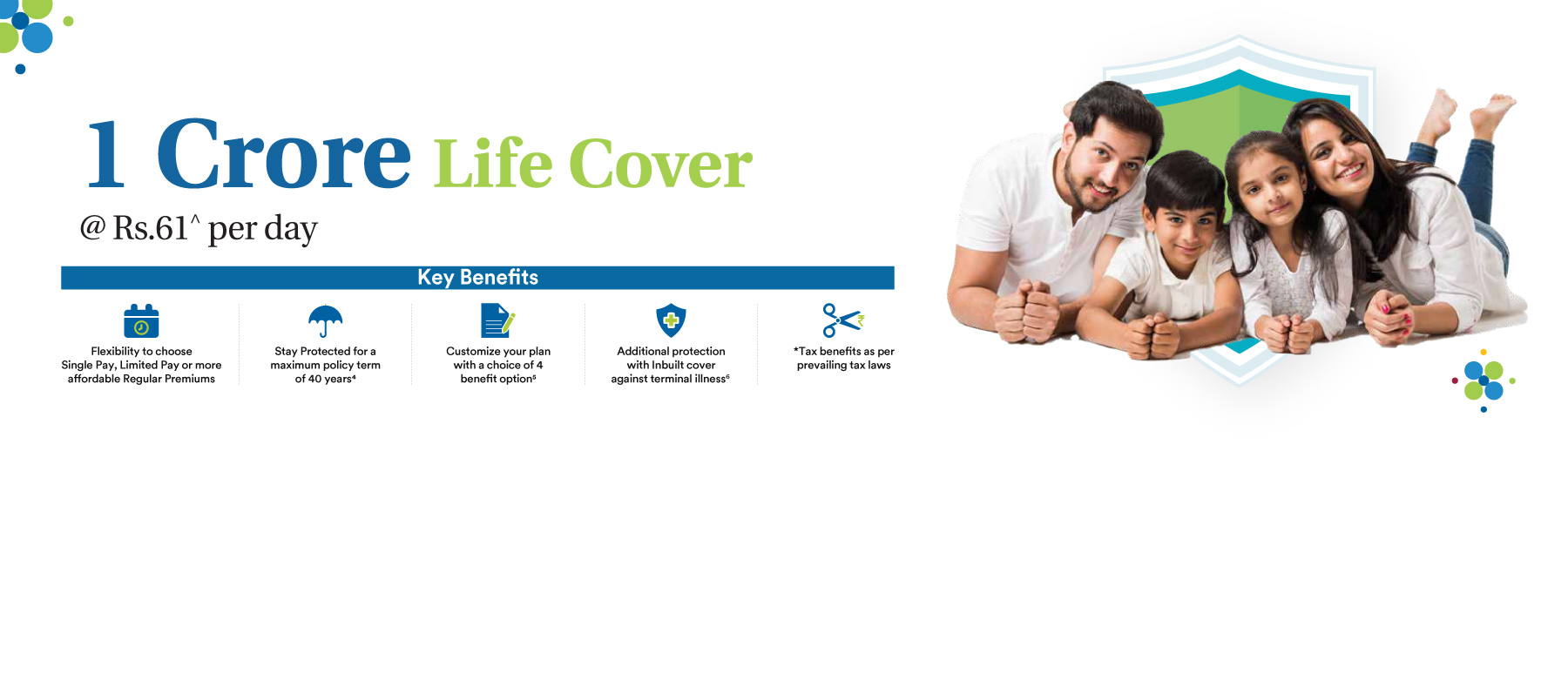

Created to give you not only a secure future but also live happily in the present, PNB MetLife Aajeevan Suraksha Plan keeps you protected as long as you want (up to the age of 99) while also letting you choose your online premium payment based on your current requirements.

Let our insurance expert call you back

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Choice of protection

You can choose to stay protected for Whole of life or Fixed term with coverage upto age 99 years or a coverage of 10 to 40 years1

Choice of payment

You can choose to pay premiums as per your requirement for a limited term of 5 years to 15 year; pay just once and stay protected for the entire term; or pay throughout policy term by choosing Regular Pay

Choice of return on Premiums

You can opt ‘With Return of Premium3’ Option to get your premiums back on survival till maturity.

Customize your plan

With a choice of 4 Benefit Options, you can customise your plan with Lump Sum, Life Partner2, Fixed Income and Increasing Income

What you don’t get

Suicide Exclusion

If the Life Assured’s death is due to suicide within 12 months from the date of commencement of risk or from the Date of Revival of the Policy, the Nominee or beneficiary of the Policyholder shall be entitled to at least 80% of the total Premium paid till the date of death or Surrender Value available as on the date of death, whichever is higher, provided the Policy is in In force status .

PNB MetLife Aajeevan Suraksha is a comprehensive family protection plan that gives you the convenience to pay premiums for a shorter period while keeping you protected for life (up to age 99), or till the term of your choice. You can also choose to cover your spouse in the same plan and choose return of premiums on survival till the end of the policy term which makes it a truly flexible offering. So, opt for PNB MetLife Aajeevan Suraksha and say goodbye to all your worries for life!

Death or Terminal Illness Benefit shall be payable according to the benefit option chosen by policyholder at inception. Benefit option, once chosen, cannot be altered during the policy term.

At inception, you have to choose the lump sum payable immediately on first occurrence of Death or diagnosis of Terminal Illness of the life assured during the policy term. This lump sum amount is equal to Sum Assured on Death. This benefit option can be availed with both ‘Fixed Term Cover’ and ‘Whole Life Cover’ options.

Both the Policyholder (the first life) and his/her spouse (the second life) are covered. Cover for second life would be available upon payment of additional premiums.

At inception, you have to choose the lump sum payable immediately on first occurrence of Death or diagnosis of Terminal Illness of the first life during the policy term. The cover to the Second life shall be less than or equal to 50% of the lump sum amount chosen for the first life, subject to a minimum of Rs.25 lakhs and a maximum of Rs. 1 Crore.

The lump sum amount payable in respect of each life is equal to Sum Assured on Death in respect of each life.

This benefit option can only be availed with Fixed Term Cover option.

At inception, you have to choose the Monthly Income amount. On first occurrence of Death or diagnosis of Terminal Illness, Sum Assured on Death shall be payable. Sum Assured on Death is equal to lump sum amount (equal to 100 times of Monthly Income chosen at the time of inception) payable immediately plus fixed Monthly Income payable over 10 years (120 months) in instalments, where the first instalment of monthly income will be payable one month from date of death of the life assured. The policy terminates with the payment of the last instalment of Monthly Income.

This benefit option can be availed with both ‘Fixed Term Cover’ and ‘Whole Life Cover’ options.

At inception, you have to choose the Monthly Income amount. On first occurrence of Death or diagnosis of Terminal Illness, Sum Assured on Death shall be payable. Sum Assured on Death is equal to lump sum amount (equal to 100 times of Monthly Income chosen at the time of inception) payable immediately plus increasing Monthly Income payable over 10 years (120 months) in instalments increasing at 10% simple per annum, where the first instalment of monthly income will be payable one month from date of death of the life assured. The policy terminates with the payment of the last instalment of Monthly Income.

This benefit option can be availed with both ‘Fixed Term Cover’ and ‘Whole Life Cover’ options.

Please refer Terms and Conditions of the product for more details on death benefit

Please refer Terms and Conditions of the product for more details on maturity benefit

| Particulars | Minimum | Maximum | ||||||

|---|---|---|---|---|---|---|---|---|

| Entry Age7 (Years) | 18 | 65 | ||||||

| Maximum Maturity Age7 (Years) |

|

|||||||

| Sum Assured (Rs.) | 25,00,000 | No limit, subject to Board approved underwriting policy | ||||||

| Premium (Rs.) | Regular Pay: 3,975 Other than Regular Pay: 5,000 |

Based on the Basic Sum Assured, Entry Age, Policy Term, Premium payment term, Smoker Status, Benefit Option, Cover Option and Return of Premium Option chosen | ||||||

| Premium payment term (PPT) (Years) | Single pay: Single premium payment at inception of the Policy Limited pay: 5 to 15 Regular pay (Regular Pay is only available with Fixed Term Option) |

|||||||

| Policy term (PT) (Years) | Single pay, Regular pay : 10 Limited pay : Premium payment term + 5 |

For both Single pay & Limited pay options

|

||||||

| Riders8 | PNB MetLife Accidental Death Benefit Rider Plus (117B020V04) PNB MetLife Serious Illness Rider (117B021V04) |

|||||||

3 'With Return of Premiums' option will be available on payment of additional premium and this option will be available only with 'Fixed Term Cover' option

7All references to age are as on age last birthday

8Rider Sum Assured shall be subject to Sum Assured of base policy. Premium for all health riders put together shall be subject to a ceiling of 100% of the base premium. Premium for all non-health riders put together shall be subject to a ceiling of 30% of the base premium. Riders will only be available with Single Pay, Regular Pay and Limited Pay with Premium Payment Terms of 5 years, 7 years, 10 years, 12 years and 15 years. Riders will not be offered if the outstanding term under the base policy is less than 5 years. Rider can be attached only at the inception of the policy

Disclaimer:

AD-F/2024-25/851

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice