Individual Non-Linked, Non-Par, Pure Risk Premium, Life Insurance Plan | UIN: 117N126V04

PNB MetLife Mera Term Plan Plus is a family protection plan that provides you and your family with a comprehensive life coverage at a very nominal cost. The plan offers you flexibility to choose protection against Death, Critical Illness2, Accidental Disability2, and Terminal Illness7 along with various additional options like spouse coverage and whole life protection. You can also customize your coverage with various cover enhancement5 options available under the plan.

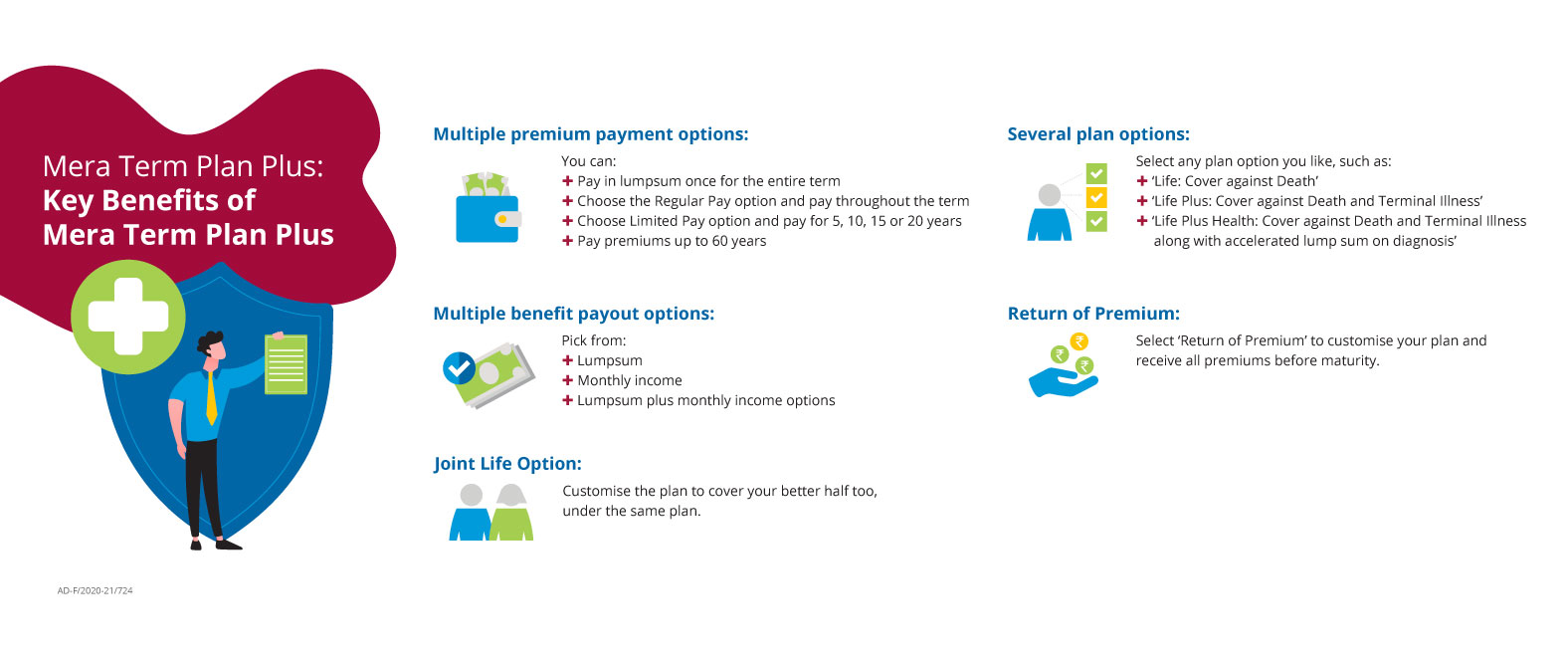

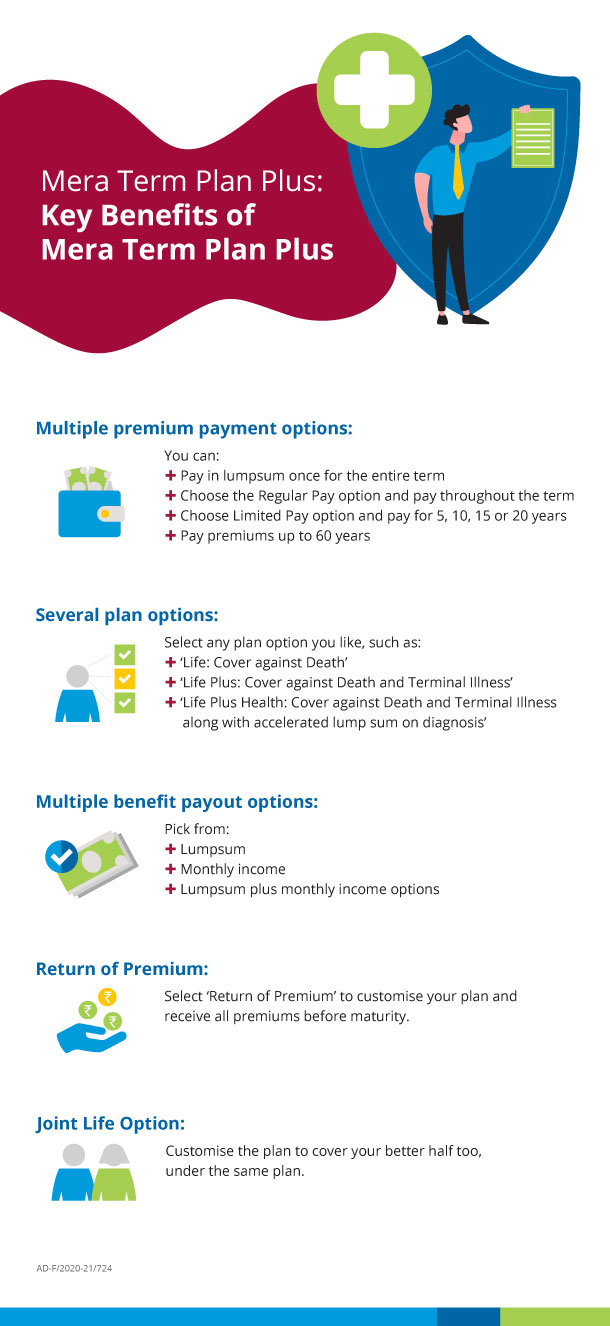

Choice of 3 Benefit Options1

Get to choose among Life, Life Plus, and Life Plus Health Benefit Options depending upon the type of coverage that you want.

Payout Flexibility

Choose to receive your benefits as a lumpsum, monthly income over 10 years, or as a combination of both.

Spouse Coverage

On payment of an additional premium, you can cover your spouse under the same plan!

Return of Premiums4

On payment of an additional premium, you can choose to get back all premiums paid on survival till maturity.

Claim Settlement Ratio for Individual Business

We have settled 99.57%* of claims received for individual business and 99.72%* for the group business for FY 2024-25. *Please visit IRDAI website www.irdai.gov.in for further details.

Get extended coverage till 99^ years of age.

Increase your coverage by 10% every year for the next 10 years.

Get the flexibility to increase your life coverage at key milestones.

Get an additional layer of protection exclusively towards your children's education expenses.

Get additional protection for your policy by opting for riders.

The Step Up Sum Assured is added at every policy anniversary starting from first policy anniversary for the next 10 years. The Step Up Sum Assured is equal to the Step Up Rate (fixed at 10%) multiplied by the Basic Sum Assured. An additional premium will be charged for every addition of Step Up Sum Assured, based on the age attained by the policyholder and the outstanding policy term, at the time.

Choose to increase the Sum Assured at various life stages as mentioned below:

You can choose to increase the Sum Assured with the specific goal of providing for the cost of education of one child of the Life Assured. Additional premiums will be charged from the Date of Inception of this benefit. Child Education Support Benefit Sum Assured at inception is equal to the estimated outstanding total cost of education, and reduces at every policy anniversary, provided that no claim for Death or Diagnosis of Terminal Illness (if Life Plus or Life Plus Health Benefit Option is chosen) of the Life Assured is admitted during the term of Child Education Support Benefit. This option can be chosen only if the nominated child has 5 to 19 years of education left for completion of graduate degree. This additional Sum Assured is subject to a minimum of Rs. 10 Lakhs and a maximum of Rs. 1 Cr.

The following riders will be offered along with this plan:

What you don’t get

Suicide Exclusion

If the Life Assured’s death is due to suicide within 12 months from the date of commencement of risk or from the Date of Revival of the Policy, the Nominee or beneficiary of the Policyholder shall be entitled to at least 80% of the total Premium paid till the date of death or Surrender Value available as on the date of death, whichever is higher, provided the Policy is in In force status.

Additional Exclusion for Life Plus / Life Plus Health Option

No benefits shall be applicable if Accidental Total Permanent Disability or Critical Illness is caused or aggravated directly or indirectly, wholly or partly by any one of the following.

• Intentional self-inflicted injury, attempted suicide.

• Any pre-existing condition.

• War, terrorism, invasion, act of foreign enemy, hostilities (whether war be declared or not), armed or unarmed truce, civil war, martial law, mutiny, rebellion, revolution, insurrection, military or usurped power, riot or civil commotion, strikes

• Taking part in any naval, military or air force operation during peace time.

• Participation by the insured person in an assault, a criminal offence, an illegal activity or any breach of law with criminal intent.

• Engaging in or taking part in professional sport(s) or any hazardous pursuits, including but not limited to, diving or riding or any kind of race; underwater activities involving the use of breathing apparatus or not; martial arts; hunting; mountaineering; parachuting; bungee jumping.

• Alcohol or Solvent abuse or taking of Drugs, narcotics or psychotropic substances unless taken in accordance with the lawful directions and prescription of a registered medical practitioner.

• Participation by the insured person in any flying activity, except as a bonafide, fare paying passenger or pilot and cabin crew of a commercially licensed airline.

• Nuclear contamination: The radioactive, explosive or hazardous nature of nuclear fuel materials or property contaminated by nuclear fuel materials or accident arising from such nature.

Additional exclusions for Critical Illnesses

• Any disease occurring within 90 days of the start of coverage (i.e. during the waiting period) or date of reinstatement whichever is later.

• Any external congenital condition.

Policyholder at inception of this policy may choose to cover his/her spouse under the same policy by paying an additional premium. The spouse is referred to as the “Second Life” and the policyholder is referred to as the “First Life” for the purpose of this benefit.

Only the Death Benefit is offered to the Second Life and the Sum Assured on Death of Second Life shall be payable in lumpsum only. To avail this benefit, the Basic Sum Assured with respect to the First Life should be equal to or greater than Rs. 50 Lakhs. The coverage to the Second Life shall be up to 100% of the Basic Sum Assured of the First Life, subject to Our Board approved underwriting guidelines. The Second Life issuance will be subject to underwriting as per underwriting guidelines. If the Second Life is a housewife or a non-earning female, the coverage for the Second Life will be restricted to up to 50% of the Basic Sum Assured chosen by the First Life, subject to maximum of Rs. 50 Lakhs. Please refer to the Sales Brochure for further details.

The policyholder may opt for this benefit at inception of the policy. For policies where the ‘Return of Premiums’ option is chosen, the Maturity Benefit equal to the Sum Assured on Maturity is payable, provided that the Life Assured survives till the Maturity Date of the policy. This option is available with a maximum policy term of 40 years or maturity age of 75 years last birthday, whichever is earlier.

Refer to the below table for the eligibility criteria to purchase this plan:

Parameter |

Minimum |

Maximum |

|

6Age at Entry (yrs) |

18 |

60 (55 if 'Pay till Age 60' is chosen as PPT) |

|

Age at Maturity |

Without RoP |

28 |

Life, Life Plus : 99 |

With RoP |

28 |

75 |

|

Sum Assured (Rs.) |

25,00,000 |

No limit, subject to Underwriting |

|

Premium (Rs.) |

Based on the Basic Sum Assured, Entry Age, Policy Term, Premium payment term, Smoker Status, Benefit Option, Cover Option and Return of Premium Option chosen |

||

Premium Paying Term (yrs) |

(Minimum allowed Policy Term for Limited pay option: Premium Payment Term plus 5 years) |

||

Policy Term (yrs) |

10 |

Without RoP: |

|

6All Age as of last birthday

The policyholder can choose any one from following 3 Cover Enhancement Options at inception of the policy. The total Sum Assured for Cover Enhancement Benefits cannot exceed 100% of the Basic Sum Assured at any time during the term of the policy.

Step Up Benefit

The Step Up Sum Assured is added at every policy anniversary starting from the first policy anniversary for the next 10 years. The Step Up Sum Assured is equal to the Step Up Rate multiplied by the Basic Sum Assured. The Step Up Rate is fixed at 10%. An additional premium will be charged for every addition of Step Up Sum Assured based on the age attained by the policyholder and the outstanding policy term at the time.

Note: This benefit is not eligible for payment under the ‘Accelerated Critical Illness Benefit’. There will be no further increase in the Step Up Sum Assured from the policy anniversary following any claim for ‘Waiver of Premium Benefit2’ or ‘Accelerated Critical Illness Benefit’ with respect to the Life Assured (First Life in case Spouse Cover is chosen).

Life Stage Benefit

Under this option, you may opt to increase the Sum Assured at various life stages mentioned hereunder. Life Stage Sum Assured can be added without further underwriting on any of the below specified events in the life of the Life Assured:

The maximum additional Sum Assured put together under all these events will be Rs. 50 Lakhs. Premium for the Life Stage Benefit will be charged separately, in addition to the base premium, for every addition of Life Stage Sum Assured. Premium for Life Stage Benefit shall be based on the attained age of the Life Assured, Life Stage Sum Assured, and outstanding policy term at the time of addition of the Life Stage Sum Assured and the benefit option chosen on date of inception of the policy.

Note: This Benefit is not eligible for payment under the ‘Accelerated Critical Illness Benefit’. There will be no further increase in the Life Stage Sum Assured post any claims in respect of ‘Waiver of Premium Benefit2’ or ‘Accelerated Critical Illness Benefit’.

Child Education Support Benefit

Under this option, you may opt to increase the Sum Assured with a specific focus to provide for the cost of education of one child of the Life Assured. Additional premiums will be charged from the date of inception of this benefit. Child Education Support Benefit Sum Assured at inception is equal to the estimated outstanding total cost of education and reduces at every policy Anniversary, provided that no claim for Death or Diagnosis of Terminal Illness (if Life Plus or Life Plus Health Benefit Options are chosen) of the Life Assured is admitted during the term of Child Education Support Benefit. This option can be chosen only if the nominated child has 5 to 19 years of education left for completion of graduate degree. This additional Sum Assured is subject to a minimum of Rs. 10 Lakhs and a maximum of Rs. 1 Cr.

Note: This benefit terminates upon payout of the Child Education Support Sum Assured on Death/Diagnosis of Terminal Illness (if applicable as per chosen benefit option) or upon expiry of the term of Child Education Support Benefit. This benefit is not eligible for payment under the ‘Accelerated Critical Illness Benefit’.

Disclaimer:

6Tax benefits are as per the Income Tax Act, 1961, & are subject to amendments made thereto from time to time. Please consult your tax consultant for more details. Goods and Services Tax (GST) shall be levied as per prevailing tax laws which are subject to change from time to time.

7An advanced or rapidly progressing incurable disease where, in the opinion of two independent Medical Practitioners’ specializing in treatment of such illness, life expectancy is no greater than twelve months from the date of notification of claim to Us.Benefit option, chosen at inception, cannot be altered during the term. Please read the Sales brochure carefully before concluding any sale.

AD-F/2024-25/866

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice