HEALTH

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

Immunity is the body's defense mechanism consisting of a complex network of cells, tissues, and organs that protects against infectious bodies. The immune system keeps us healthy by warding off foreign bodies. But when the immune system cannot protect you, a health insurance policy can assuage the pain.

Here’s the thing with the immune system: it tends to get weaker as we grow older. With age, the body stops reacting to vaccines as efficiently as it used to. The immune function wanes in all adults as they enter their fifth decade and beyond, whether they are healthy or sick notwithstanding.

There is even a term for this: immunosenescence. It refers to the gradual deterioration of the immune system because of the natural ageing process. Studies have pointed at the inevitability of this phenomenon . Not only do we have fewer immune cells as we age, but the ones that we do have also don’t communicate with each other as well. That means they take longer to react to harmful germs.

That’s not the only impact of the body producing fewer immune cells, including white blood cells. The result is also that your recovery from injuries, infections, or illnesses slows down.

Collectively, ageing causes an increasingly pro-inflammatory state. This, in turn, implies reduced immunity to infections and reduced response to vaccines. This renders people more susceptible to diseases.

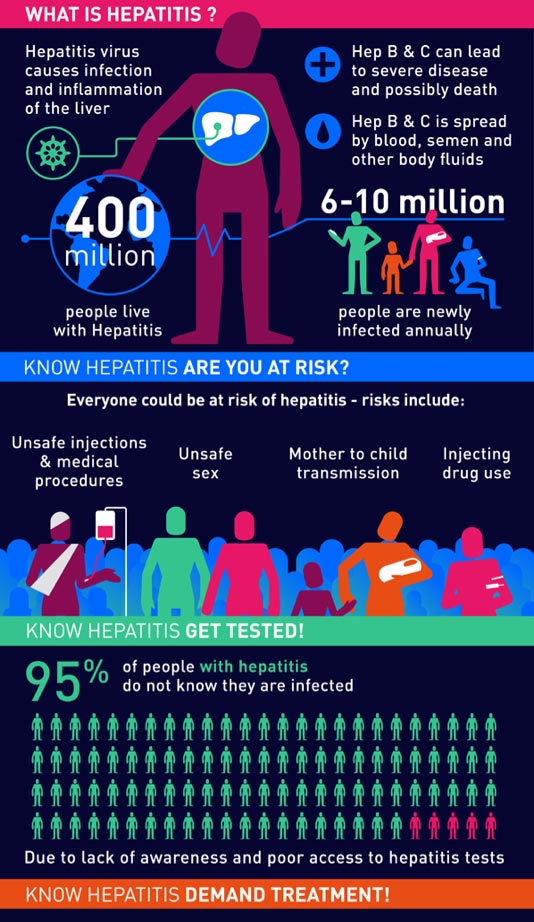

Because inflammation is the major pain point, our liver is gravely affected too. It loses its resilience and ageing leaves our livers more vulnerable to inflammation, scarring and cancer from the hepatitis B virus that hijacks liver cells to replicate. On World Hepatitis Day, the World Health Organisation (WHO) and other organizations will disseminate information about it: hepatitis is an inflammation of the liver. From that, it follows that with age the threat of hepatitis also increases. While efforts to eliminate hepatitis are gaining momentum, and access to hepatitis C curative therapy is increasing, you might be caught unawares.

A World Hepatitis Day graphic from WHO depicts that 95% of people with hepatitis don’t even know they are infected. Thus, there’s much to be done here.

Underneath all this medical jargon, the bottom line is this: with increasing age, our immune system is just not as robust as it used to be.

Prolonged life expectancy since the 20th century has been one of humankind’s greatest triumphs. But this also presents a novel concern: earlier we were concerned about dying too soon, now we are concerned about living too long in equal measure. Many people believe that through regular physical activity and a healthy diet, they can negate the impact of ageing, but this isn’t something within one’s immediate control. Infectious diseases will attack those with lowering immunity and prominently contribute to morbidity in the vulnerable elderly population.

It is a myth that you can control age-induced ailments through healthy ageing. Providing for unexpected health care expenses due to declining immunity is non-negotiable.

It becomes important to stay on top of your health and be prepared for any unexpected healthcare expense. The best way to provide a cushion for medical emergencies is through health insurance. While we may not be able to predict or prevent these diseases from occurring, but we can certainly protect against them financially by investing in a robust health insurance plan. Many life insurance plans will allow you to add a rider for health insurance: while a serious illness rider provides coverage for critical illnesses like cancer or heart-related diseases, a comprehensive health insurance policy can even cover the medical expenses thoroughly.

To know more about Term Insurance, browse the website for various Term Plans offered by PNB MetLife.

1 Source: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5731094/

2 Source: https://www.who.int/campaigns/hepatitis-day/2016/infographic/en/

Whether you are trying to lose weight or making a shift towards a healthy life, understanding your BMI (Body Mass Index) is one of the first necessary steps you can make. The BMI calculator can indicate your body’s fat content based on your weight and height. Once you have a clear view of this, you can go through different health insurance plans on the PNB website and secure your future financially against the growing healthcare costs.

The aforesaid article presents the view of an independent writer who is an expert on financial and insurance matters. PNB MetLife India Insurance Co. Ltd. doesn’t influence or support views of the writer of the article in any way. The article is informative in nature and PNB MetLife and/ or the writer of the article shall not be responsible for any direct/ indirect loss or liability or medical complications incurred by the reader for taking any decisions based on the contents and information given in article. Please consult your financial advisor/ insurance advisor/ health advisor before making any decision.

PNB MetLife India Insurance Company Limited

Registered office address: Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001, Karnataka

IRDAI Registration number 117 | CIN U66010KA2001PLC028883

For more details on risk factors, please read the sales brochure and the terms and conditions of the policy, carefully before concluding the sale.

Tax benefits are as per the Income Tax Act, 1961, & are subject to amendments made thereto from time to time. Please consult your tax consultant for more details.

Goods and Services Tax (GST) shall be levied as per prevailing tax laws which are subject to change from time to time.

The marks "PNB" and "MetLife" are registered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife India Insurance Company Limited is a licensed user of these marks.

Call us Toll-free at 1-800-425-6969, Phone: 080-66006969, Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex -1, Techniplex Complex, Off Veer Savarkar Flyover, Goregaon (West), Mumbai – 400062, Maharashtra. Phone: +91-22-41790000, Fax: +91-22-41790203.

| Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers! IRDAI or its officials is not involved in activities like selling insurance policies, announcing bonus or investments of premium. Public receiving such phone calls are requested to lodge a police complaint. |

By submitting your details, you agree to PNB MetLife's Privacy Policy and authorize PNB MetLife and/or its authorized service providers to verify the above information and/or contact you to assist you with the policy purchase and/or servicing. You have the option to opt-out of this contact authorization by un-checking the box. The authorization provided by you herein will supersede all earlier authorizations/registrations made by you in this regard.

As your trusted life insurance partner, PNB MetLife covers COVID-19 claims. In the event of a death claim, please submit a signed claim form mentioning the policy number, a brief description of the insured event, and all other mandatory claim documents to the email addresses provided below. You may write to us at claimshelpdesk@pnbmetlife.com or indiaservice@pnbmetlife.co.in. For death claim intimation or any queries, you can also call us at 1800-425-6969 (for customers calling from within India only), Monday to Saturday, between 10:00 am and 7:00 pm.

PNB MetLife Insurance, amongst the trusted Life Insurance companies in India, aims to provide a wide range of Life Insurance products that suits the needs of an individual at every stage of his life. Life Insurance Plans range from Term Life Insurance Plans, Term Plan, Protection Plans, Long Term Savings Plans , Retirement Plans & Child Education Plan.

Get Trusted Advice

Get Trusted Advice